My bank has been trying to solve on-boarding for the last 25 years via a variety of on-boarding systems. Given the vagaries of budget cycles, people’s preferences and technology choices, we ended up with over 10-15 systems that did on boarding for specific products, regions and type of clients like Commodities / FX / Derivatives / Options / Swaps / Forwards / Prime Brokerage / OTC Clearing etc. With increased regulations especially FATCA (which I was hired to implement) meant wasteful and fractured capital expenditure in retrofitting each of these 10+ systems to be compliant with regulations.

To address this, I made the case for going to a single on-boarding platform, where we could maximize feature reuse, optimize investment and be nimble with the capabilities we were rolling out. I refocused the team to move on boarding to this single platform called “The Pipe”. This included negotiating with stakeholders to agree on bare minimum functionality that would let them move to pipe.

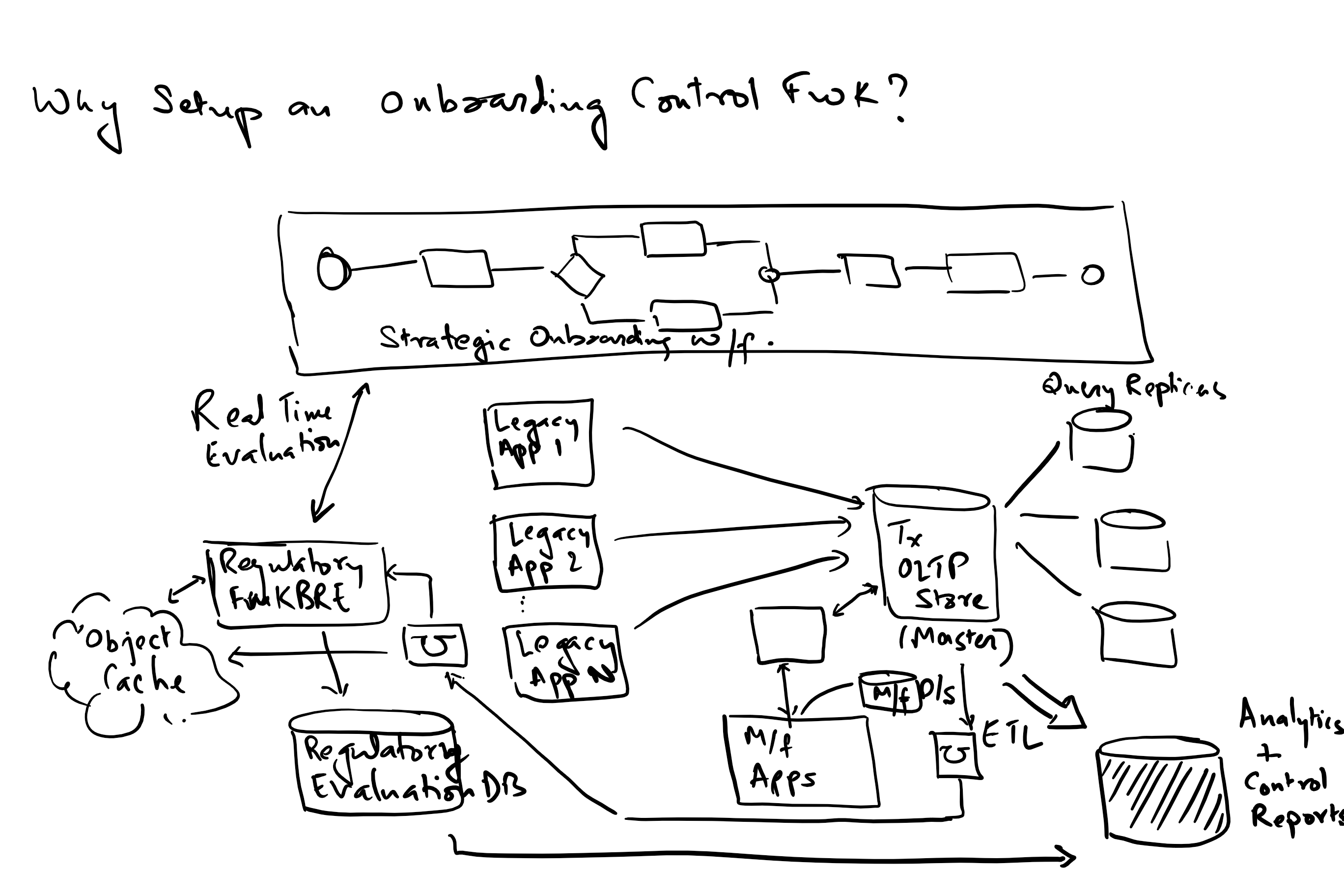

Ensured that all new feature development happened only on the go forward strategic platform. Designed an observer pattern to create FATCA cases (and later every other regulatory case) only on the pipe platform regardless of where the account or client was on-boarded. This allowed for functionality on the legacy systems to be stymied and for our business to easily move over to the strategic platform.

We streamlined delivery of functionality into a regular 4-week monthly development cycle followed by a test and deployment cycle. Achieved 99+% of all new client accounts being on-boarded on the pipe platform. Created a common regulatory platform that allows for all reg cases being created on the Pipe platform regardless of where it was created/updated. We were able to streamline development to rollout a new regulatory program in a single release cycle, which otherwise would have taken a project running for a year or more to implement. This helped us rationalize investment and also provided assurance to my business around regulatory compliance;

Happy to share details around the challenges we faced and the strategies we employed to overcome them.

As always, I welcome any comments or compare notes on a similar situation that you may have come across.