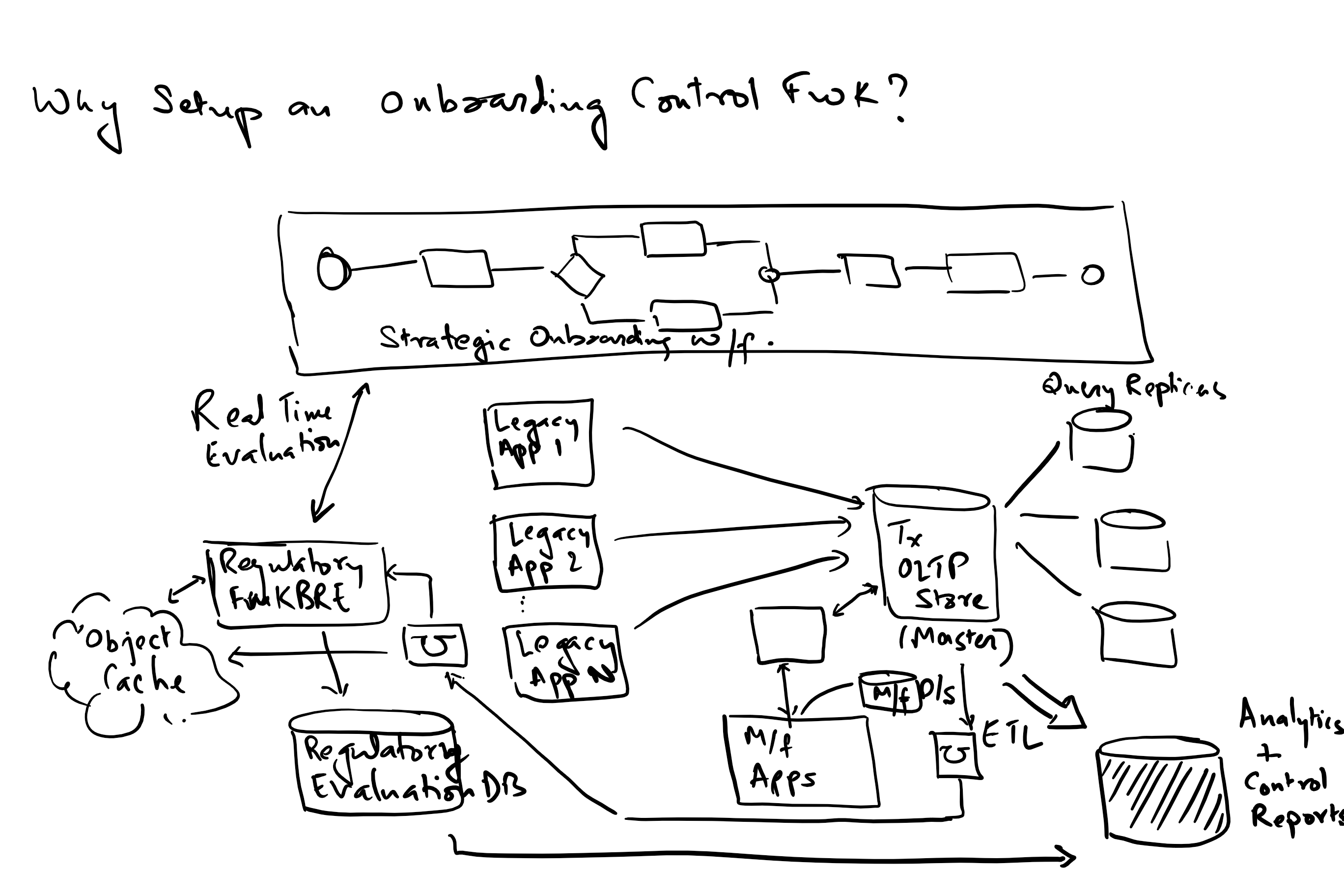

I spent a number of years building on boarding systems for a large investment bank. When I came into the role, the immediate need was to implement FATCA across a spectrum of on boarding systems, all on different tech stacks, multitude of features and functions but none able to support all of our products. This fragmentation came about because of budget pressures, needs from various product areas, separate IT teams and the lack of hygiene discipline to sunset old and end of life systems.

While we were successful in creating a state of art on boarding platform, and a scalable, flexible regulatory program framework that could handle the changing regulations from regulatory regimes across the globe, and also in bringing all of our client facing product groups to our platform; the question that kept nagging me was – is this adding to our sustainable competitive advantage?

The answer that I arrived at was – No. This is an example of an industry-wide trapped value. Every firm on the street on boards clients and creates accounts. While clients aren’t thrilled about the experience and the documentation needed, most comply, since they could not trade without this. But reasonably assuming every client has relationships to multiple brokers and/or banks – why should they be subject to multiple disjointed onboarding experiences, with every firm asking for KYC (and other regulatory programs) documentation? Therefore, there is

In my opinion, this screams of an industry wide shared service, where clients get FATCA/KYC/MiFID certified just once and use these certifications across multiple brokers or banks. This ideally is a digital asset – a compliance certificate for any regulatory program across any regime from a shared service provider that is available to query and is immutable. The individual players can then use this digital asset as an underlying precondition in their trading/transaction/lending/advisory businesses. It should then be very trivial to move the regulatory compliance costs to the shared service provider, and given the multiple clients using the service, would lead to an overall cost reduction in banking/trading/advisory sectors. The client would also be happy, given a single point for regulatory program check and compliance.

An implementation using smart contracts on an immutable blockchain that is available to all parties, reflects real time compliance stats and allows brokers and banks to rely on this to facilitate their business would be much more efficient and this seems to be the reasonable evolution for this function.

Welcome any feedback or contrarian views…