We introduced a product called Therapeutic Resource Center at Medco in 2007/8. It was an extremely innovative product that was soon copied by most of our competitors.

Here’s a brief history of how we developed this product.

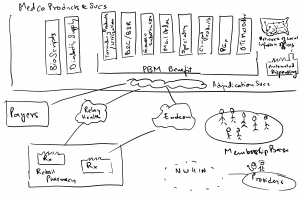

Medco consisted of two main businesses – the PBM business which basically was adjudication of a patient’s drug benefit – which drugs would be covered, what would be on the formulary, copay a patient had to cover out of pocket when filling a prescription, how much would a pharmacy be paid, what would we bill a payer for this transaction; the second was the mail order pharmacy dispensing business. Here we asked patients on maintenance medications, to fill their prescription at mail order. A patient would request their doctor to send their prescription to our MO pharmacy. We would then fill a 90 day prescription for the same copay as a retail pharmacy for a 30 day prescription.

In 2006, we were at about 100MM prescriptions at mail order and about 765MM POS adjudications annually. To drive efficiencies, we digitized incoming Rx’s to route them to the closest mail order pharmacy location for dispensing in the most cost effective way – so a patient on the west coast had their fill done from Las Vegas while a patient on the east coast would have our pharmacy in Tampa or Willingboro fulfill their order.

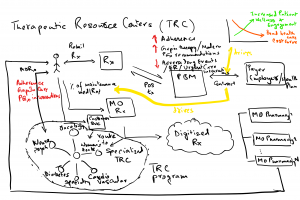

Once we had the ability to digitize Rx’s, we were also able to group, sort or route to the most efficient way of doing business. We had the same ability with customer service phone calls coming in – recognizing the ANI allowed us to know who was calling and whether they had an order with our pharmacy.

Since we also had a lot of patient data (Rx, medical claims etc.), we could stratify the patient population into various disease conditions, and if we used this stratification in routing prescriptions or calls, we had the ability to route all diabetics to a group of pharmacists that specialized in diabetes, or for neuropsych patients to the neuropsych TRC. Similarly we created the Cardiovascular, Oncology, Specialty and Women’s Health TRCs.

We then discovered that our interactions with the patients were a lot more meaningful, with our pharmacists and CS representatives becoming trusted advisors to these patients. It also meant that we were able to keep patients more adherant on taking their prescriptions as well as intervene on behalf of the patients to request a gap in care intervention when we saw a missing therapy or course of actions.

Using actuarial data, we were able to establish that while this intervention was more expensive than our regular cost effective dispensing and customer service operations, we were also able to improve patient health, bend the healthcare cost curve, reduce the adverse drug events and also introduce some new genetic testing as means of either avoiding certain treatments (using a genetic test (Abnormal CYP2D6 enzyme) before prescribing Tamoxifen for Breast Cancer treatments) or adjusting the dosage on some really poisonous ones (introducing genetic tests to regulate their dosage when a patient was first prescribed warfarin (a blood thinner)).

Given that our interventions were this effective and we had data to prove it, we introduced a product called TRC in 2007, which would entitle a client’s patients to our interventions, in return for a larger mail order penetration that drove our margins on the mail order side. This really helped both improve our margins as well as improve patient care.

Medco’s Product’s & Services:

Therapeutic Resource Center Business Model:

The above context diagram describes how our product worked, please do reach out if there are questions regarding how we designed this.